Helping our money-tight customers to save for the things that are important to them

TL;DR

An ‘end-to-end’ project to introduce a new proposition for the bank – savings. Customer interviews, surveys, ideation workshops, wireframes and UI designs.

The challenge

As part of the continuous discovery process at ThinkMoney, we had a basic understanding that our customers wanted a method of putting money aside, separate to their current account, where they could save for things. But what did this mean? What was the appetite for it? What did they truly want to be able to do?

The challenge was to fully understand what this truly meant to the customer and what it meant to the business. The initial ideas of ‘savings’ came about from insights gathered from primary and secondary research, such as product reviews (TrustPilot) and 1:1 interviews with customers at various stages of maturity with the business.

The plan

Quite simply, the plan was to start answering some of the questions we had when it came to savings and see if we could genuinely help customers save, whilst making it commercially viable for the business. The plan involved working closely with multiple senior stakeholders from engineering, product, data, security and legal. The plan would be to then deliver a solution that helped customers save money.

It was really important that everyone didn’t jump to conclusions or solutions before a comprehensive Discovery phase had been carried out, which can be difficult when parts of the business are so delivery focussed!

Discover

This phase was broken down into 2 separate sections:

Primary research using surveys, polls and 1:1 interviews with existing customers and those that weren’t our customers.

Secondary research from qualitative data sources such as reviews from app stores, TrustPilot, the customer services team (contact centre) and also a competitor review of those that offered something similar.

Primary Research

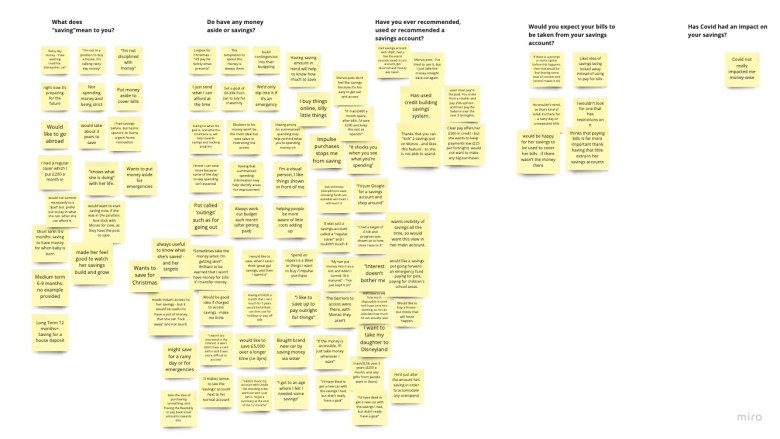

The main part of my primary research were 1:1 remote interviews with 7 customers and 7 non-customers. I compiled a discussion guide as a point of reference when talking to candidates, careful not to introduce bias and lead them down a certain path. I coached a member my UX Research team to lead the interview as the facilitator, whilst I acted as the observer, taking notes and providing additional prompts to the UX Researcher where I felt necessary. All raw notes were captured in Confluence, with problem areas, insights and affinity mapping done in Miro.

Additionally, I lead the development and delivery of a survey to 2000 customers, asking them of their behaviours, thoughts and feelings when it came to savings

Finally, for those who were a mix of customer and non-customer, I organised for the marketing team to get further information from a Twitter Poll, where a simple

Secondary Research

My secondary research started with research papers already in existence – the UK government and private banks publish research on personal finances at least every year. This gave me a good insight into the ‘general state of play’, uncovering broader insights.

I also conducted a competitor analysis for similar features, products and functionality, so I could easily create a point of reference and also understand limitations, existing methods and any nuances.

Define

Now my research was complete, I then looked to define the problem/s and the possible solution through workshops, ideation and validations. Here’s the steps I followed…

From the affinity map, I produced user need statements (problem statements) which concisely captured each area of insight. Using an opportunity solution tree map, myself and the Senior Product Owner decided which areas we would take further i.e. which problems to tackle first, and which might relate to each other.

Once the problem statement of focus was decided, I set about developing some How Might We questions ready for a multi-disciplinary ideation workshop, where we’d focus on actually solving the problems.

From there, I ran a remote ideation workshop from key representatives from across the business, including development, compliance, legal, fraud etc. We then set about trying to creatively solve some problems!

Once the working group had come up with ideas, great, small, crazy and insightful, I then grouped them all into categories (another Affinity Map) and we all voted for which ideas we believed to have the most impact when it came to our HMW questions.

After the workshop working with the PO, head of development, head of delivery & CEO, I mapped out which ideas to take forward using a Feasibility, Desirability, and Viability Scorecard.

I’m also keen to get workshop feedback after each session I run, to ensure the participants found it useful, insightful and that they were contributing to the process, based on their expertise. This is the collated feedback from attendees:

Design

Here is started with a few userflows, a sitemap and wireframes of key pages, that met the needs of an MVP.

This allowed us to quickly review the functionality and how the user would navigate through it before putting it in front of users. This internal Guerrilla testing proved an effective method to catching some usability snags.

After initial usability testing with a wireframe prototype, I worked with a talented UI Designer in my team to bring it to life, ensuring we had accessibility and usability at the front of mind.

In this note, we developed a couple of different executions so I could split-test different layouts and ways of completing tasks, to see which was most effective and resonated with our users.

Any features that weren’t included in the MVP were fed into the product pipeline until the prototypes were tested.

I pushed for the CEO to get a User Testing licence for me and my team, which, after putting several business cases together and multiple meetings with UT, we finally got! I prepared the prototypes, wrote the test scripts, arranged participant recruitment and defined the measures of success, all ready for initial validation and usability testing.

Unfortunately, the work on this savings project was put on halt whilst I looked at customer journey mapping for new customers in order to optimise the experience (this was deemed a priority for revenue).

You must be logged in to post a comment.